This data set gives the number of bids received by 126 US firms that were successful

targets of tender offers during the period 1978--1985, along with some explanatory

variables on the defensive actions taken by management of target firm, firm-specific

characteristics and intervention taken by federal regulators. The takeoverbids

data frame has 126 observations on 14 variables. The descriptions below are taken from

Sáez-Castillo and Conde-Sánchez (2013).

data(takeoverbids)Format

A data frame with 126 observations on 14 variables.

- bidprem

bid price divided by price 14 working days before bid

- docno

doc no

- finrest

indicator variable for proposed change in ownership structure

- insthold

percentage of stock held by institutions

- leglrest

indicator variable for legal defence by lawsuit

- numbids

number of bids received after the initial bid

- obs

Identifier

- rearest

indicator variable for proposed changes in asset structure

- regulatn

indicator variable for Department of Justice intervention

- size

total book value of assets in billions of dollars

- takeover

Indicator. 1 if the company was being taken over

- weeks

time in weeks between the initial and final offers

- whtknght

indicator variable for management invitation for friendly third-party bid

- sizesq

book value squared

Source

Journal of Applied Econometrics data archive: http://qed.econ.queensu.ca/jae/.

References

Cameron, A.C. and Johansson, P. (1997). Count Data Regression Models using Series Expansions: with Applications. Journal of Applied Econometrics 12 203--223.

Cameron, A.C. and Trivedi P.K. (1998). Regression analysis of count data, Cambridge University Press, http://cameron.econ.ucdavis.edu/racd/racddata.html chapter 5.

Croissant Y (2011) Ecdat: Datasets for econometrics, R Package, version 0.1-6.1.

Jaggia, S. and Thosar, S. (1993). Multiple Bids as a Consequence of Target Management Resistance Review of Quantitative Finance and Accounting 3, 447--457.

Examples

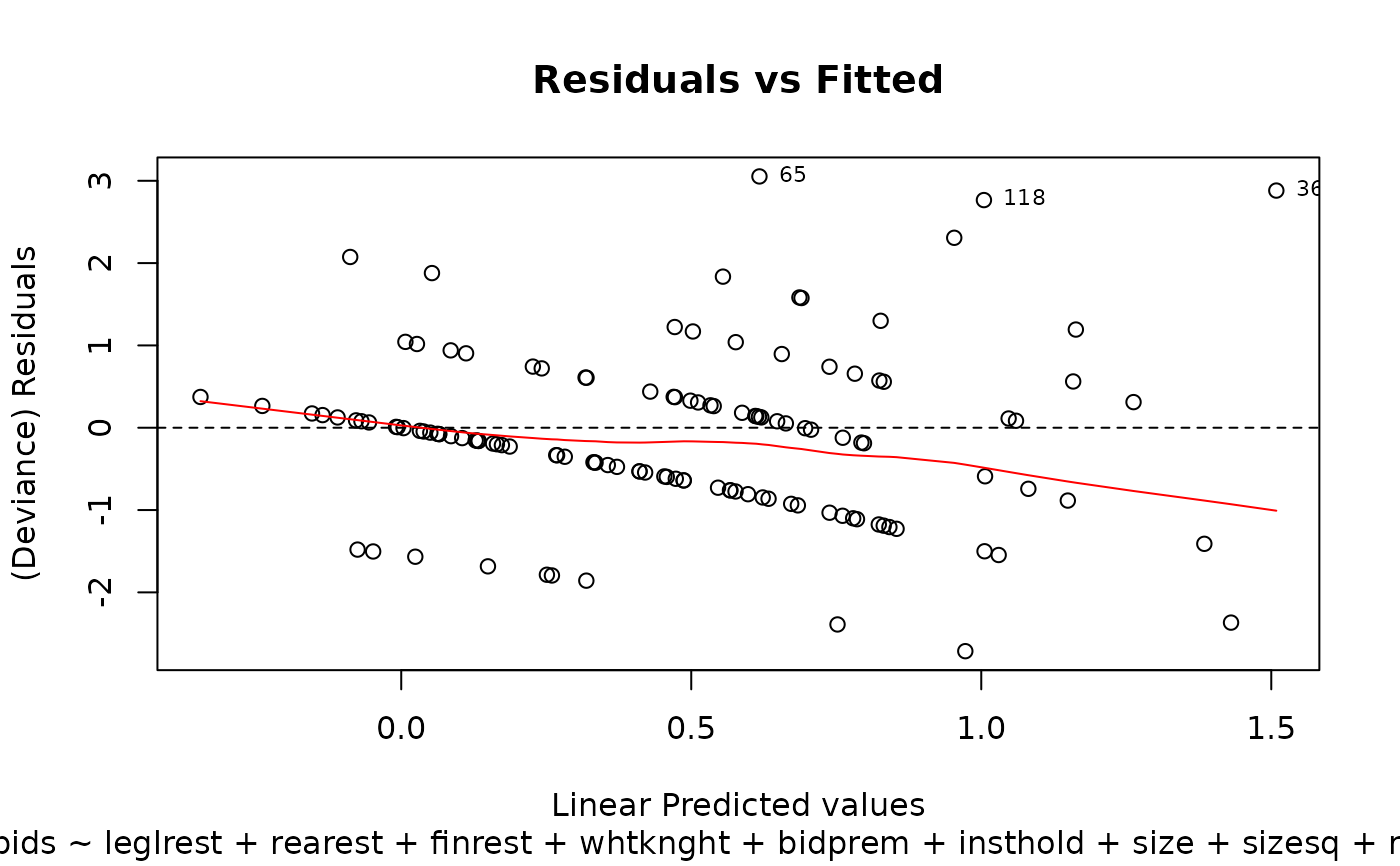

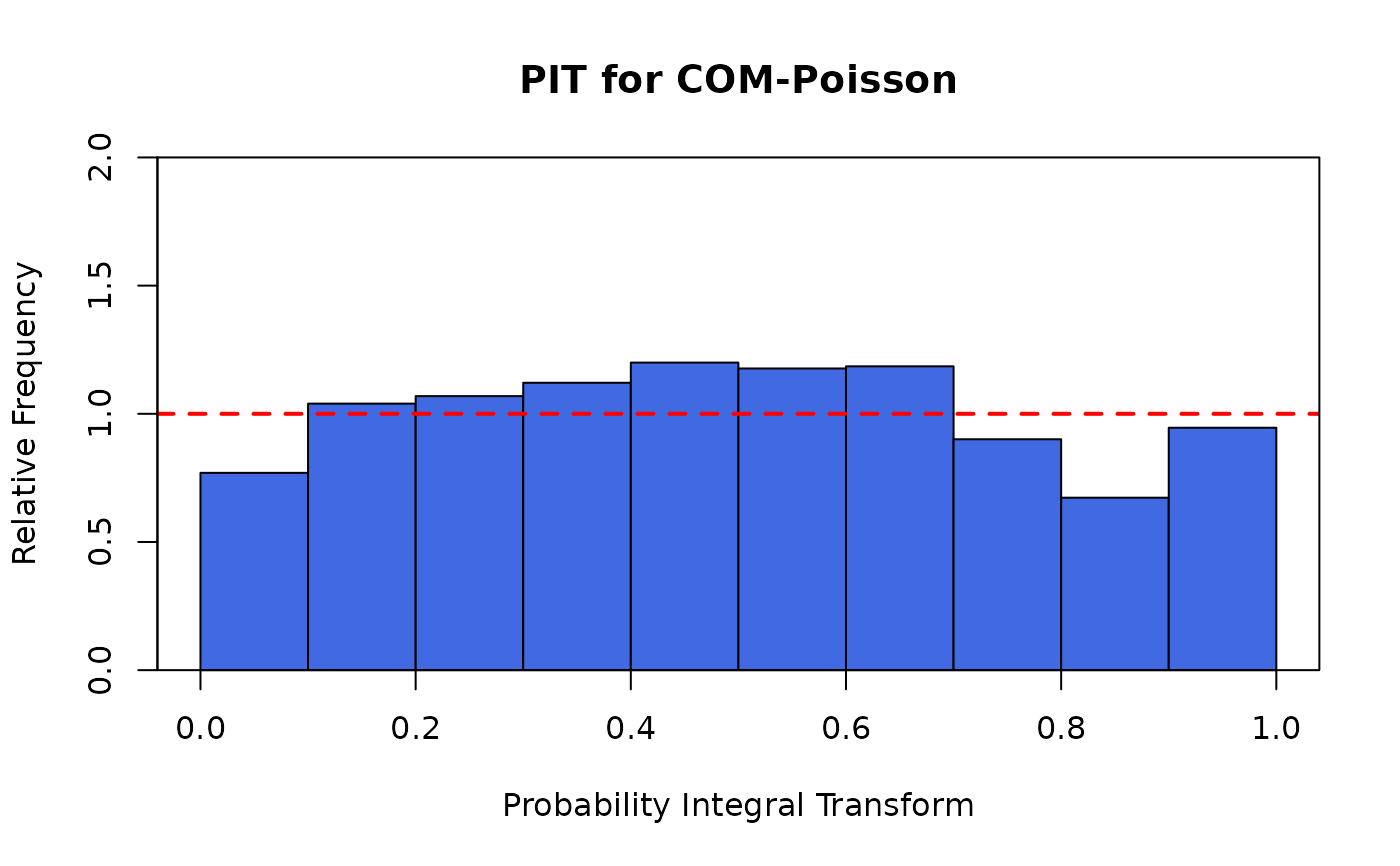

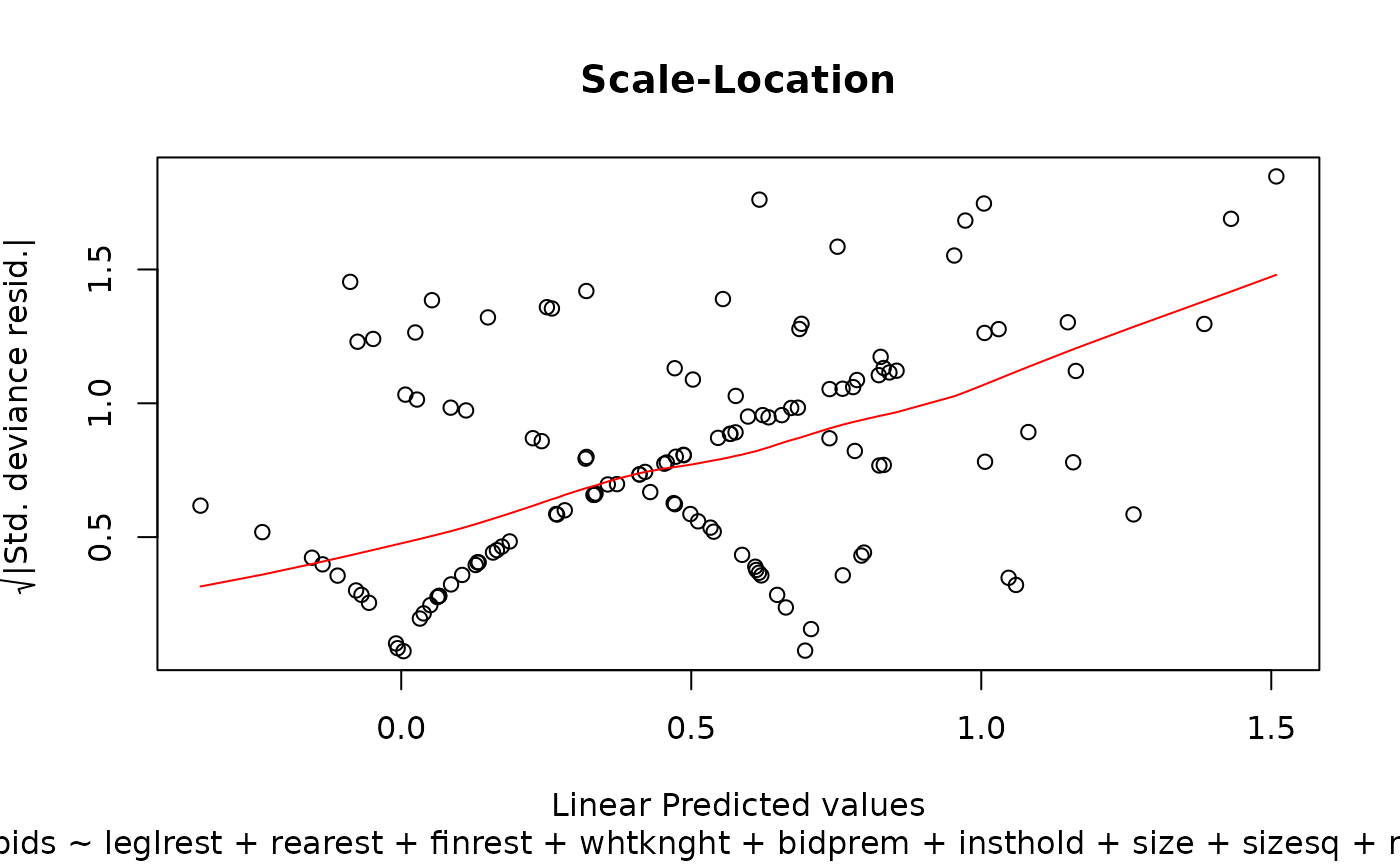

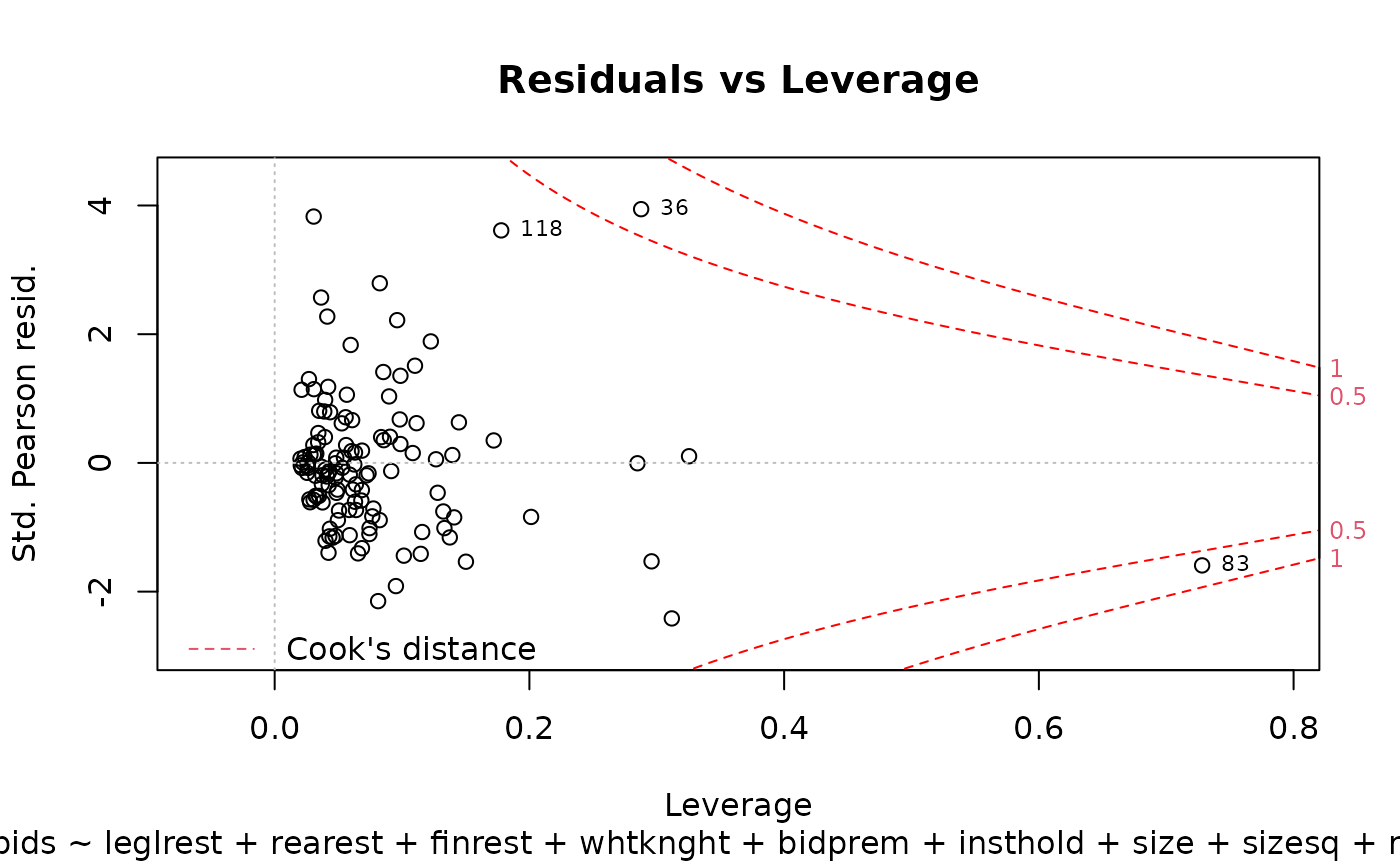

### Huang (2017) Page 371--372: Underdispersed Takeover Bids data

data(takeoverbids)

M.bids <- glm.cmp(numbids ~ leglrest + rearest + finrest + whtknght

+ bidprem + insthold + size + sizesq + regulatn, data = takeoverbids)

M.bids

#>

#> Call: glm.cmp(formula = numbids ~ leglrest + rearest + finrest + whtknght +

#> bidprem + insthold + size + sizesq + regulatn, data = takeoverbids)

#>

#> Linear Model Coefficients:

#> (Intercept) leglrest rearest finrest whtknght bidprem

#> 0.9896300 0.2678800 -0.1731800 0.0677440 0.4812800 -0.6848200

#> insthold size sizesq regulatn

#> -0.3678900 0.1793300 -0.0075823 -0.0375690

#>

#> Dispersion (nu): 1.75

#> Degrees of Freedom: 125 Total (i.e. Null); 116 Residual

#> Null Deviance: 182.3906

#> Residual Deviance:

#> AIC: 382.1753

#>

summary(M.bids)

#>

#> Call: glm.cmp(formula = numbids ~ leglrest + rearest + finrest + whtknght +

#> bidprem + insthold + size + sizesq + regulatn, data = takeoverbids)

#>

#> Deviance Residuals:

#> Min 1Q Median 3Q Max

#> -2.71432 -0.70635 -0.07758 0.36084 3.05289

#>

#> Linear Model Coefficients:

#> Estimate Std.Err Z value Pr(>|z|)

#> (Intercept) 0.989630 0.435366 2.273 0.023020 *

#> leglrest 0.267879 0.122873 2.180 0.029248 *

#> rearest -0.173177 0.154779 -1.119 0.263197

#> finrest 0.067744 0.174403 0.388 0.697693

#> whtknght 0.481281 0.131721 3.654 0.000258 ***

#> bidprem -0.684822 0.307627 -2.226 0.026005 *

#> insthold -0.367886 0.346799 -1.061 0.288780

#> size 0.179325 0.047627 3.765 0.000166 ***

#> sizesq -0.007582 0.002485 -3.052 0.002276 **

#> regulatn -0.037569 0.130303 -0.288 0.773101

#> ---

#> Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

#>

#> (Dispersion parameter for Mean-CMP estimated to be 1.752)

#>

#>

#> Null deviance: 182.39 on 125 degrees of freedom

#> Residual deviance: 131.20 on 116 degrees of freedom

#>

#> AIC: 382.1753

#>

plot(M.bids) # or autoplot(M.bids)